Guide to Finding the Best Financial Advisors Near You

Finding the right financial advisor is essential for effective financial management. Whether planning for retirement, investing, or managing wealth, selecting a top local advisor is key. This guide will help you navigate the process to make an informed decision.

Understanding Different Types of Financial Advisors

Financial advisors come in various forms, each specializing in different areas of finance. Here are the main types you might encounter:

- Certified Financial Planners (CFP): These professionals are rigorously tested and certified, ideal for comprehensive financial planning.

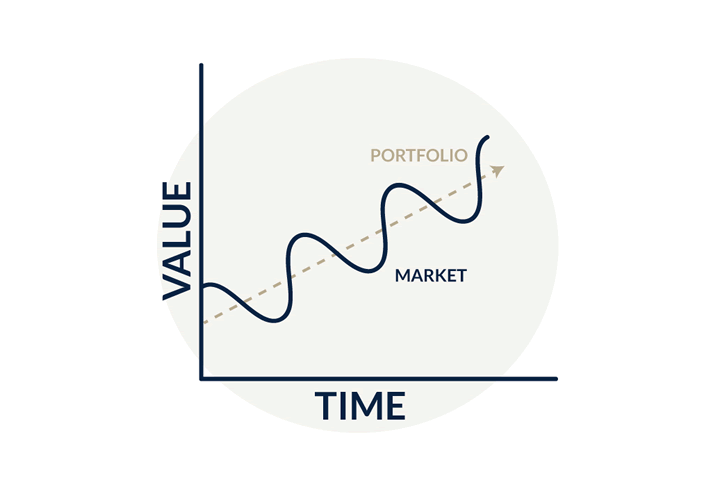

- Investment Advisors: Focus primarily on investment strategies, portfolio management, and asset allocation.

- Retirement Planners: Specialists in retirement planning, helping clients understand complex retirement products and strategies.

- Wealth Managers: Deal with high-net-worth individuals and offer holistic management of personal and family finances.

How to Locate the Best Financial Advisors Near You

To find the best financial advisors in your area, follow these steps:

- Define Your Financial Goals: Understand what you need from a financial advisor. Is it investment advice, retirement planning, tax strategies, or estate planning?

- Search for Qualified Professionals: Use tools like the National Association of Personal Financial Advisors (NAPFA) or the Financial Planning Association (FPA) to find certified professionals near you.

- Check Credentials and Reviews: Verify their certifications (such as CFP or CPA) and read online reviews to gauge their reputation.

Evaluating Financial Advisors: A Checklist

When evaluating potential financial advisors, consider the following criteria:

- Credentials: Are they certified by a recognized authority?

- Experience: How long have they been in the industry?

- Services Offered: Do they offer the services that meet your needs?

- Fee Structure: Understand how they are compensated (fee-only, fee-based, commission).

Key Questions to Ask a Financial Advisor

Prepare a list of questions to ask when meeting potential advisors:

- What are your qualifications and certifications?

- Can you provide a summary of your services and fee structure?

- How do you tailor your advice to meet individual client needs?

- What is your investment philosophy?

- Can you provide references from clients with similar financial goals as mine?

Using Professional Analysis: An Example

To further analyze the performance of financial advisors, you can use tools like Excel for detailed comparisons. Here is an example of how to structure your data in Excel:

| Advisor Name | Years of Experience | Fee Structure | Client Reviews | Services Offered |

|---|---|---|---|---|

| John Doe | 10 | Fee-only | 4.5/5 | Investment, Tax |

| Jane Smith | 15 | Commission | 4.8/5 | Retirement, Estate |

This table can help you visualize and compare the key attributes of each advisor.

Conclusion

Choosing the right financial advisor involves careful consideration and thorough research. By understanding the types of advisors, knowing what questions to ask, and how to effectively compare them, you can make a well-informed decision that aligns with your financial goals.

References

Here are three websites that provide valuable information on finding and evaluating financial advisors:

By consulting these resources, you can enhance your understanding and confidence in selecting the best financial advisor near you.

Recent Comments